The Psychology of Money Summary: Unlocking Financial Wisdom

In “The Psychology of Money,” Morgan Housel takes readers on a transformative journey into the intricate relationship between human behavior and financial decision-making. Unlike conventional finance books that focus solely on strategies and numbers, Housel delves deep into the underlying psychological factors that shape our attitudes towards money, wealth, and happiness.

Table of Contents

ToggleUnraveling the Stories We Tell Ourselves

Housel opens the book with a profound insight into the power of narratives in shaping our financial behaviors. He argues that the stories we tell ourselves about money—whether they’re tales of rags-to-riches success or cautionary tales of financial ruin—profoundly influence our attitudes and behaviors towards wealth accumulation and financial risk-taking. These narratives are often deeply ingrained in our cultural upbringing, societal norms, and personal experiences, shaping our perceptions of what it means to be financially successful and how we should navigate the complexities of the financial world.

To illustrate this point, Housel shares compelling anecdotes and real-life examples of individuals who have been influenced by powerful financial narratives. From the immigrant entrepreneur striving to achieve the American Dream to the cautious investor haunted by the memories of past market crashes, these stories highlight the diverse ways in which narratives shape our financial decisions and behaviors.

By unraveling these narratives and examining their underlying assumptions and biases, readers are encouraged to gain a deeper understanding of their own financial motivations and beliefs. This self-awareness empowers readers to challenge conventional wisdom, question societal norms, and make more intentional choices about their financial future.

Navigating the Complexities of Luck and Risk

In the subsequent chapters, Housel delves into the nuanced concepts of luck and risk, challenging readers to rethink their perceptions of success and failure in the realm of finance. While traditional finance literature often glorifies the role of hard work and merit in achieving financial success, Housel argues that luck plays a significant—and often overlooked—role in shaping financial outcomes.

Drawing on research from behavioral economics and psychology, Housel explores the cognitive biases and heuristics that lead individuals to underestimate the role of luck in their own successes and failures. He highlights the phenomenon of survivorship bias, wherein individuals tend to attribute their success to their own skills and overlook the role of external factors such as luck and timing.

To illustrate this concept, Housel shares captivating stories of both successful and unsuccessful individuals who have experienced the unpredictable twists and turns of financial markets. From the self-made millionaire who attributes his success to hard work and perseverance to the aspiring entrepreneur whose dreams are dashed by unforeseen economic downturns, these stories underscore the unpredictable nature of financial success and the importance of humility in acknowledging the role of luck.

In addition to luck, Housel explores the concept of risk and its impact on financial decision-making. He challenges readers to rethink their perceptions of risk and uncertainty, emphasizing the difference between perceived risk and actual risk. While many individuals are quick to equate risk with volatility and market fluctuations, Housel argues that the greatest risk lies in not understanding the risks we take and the potential consequences of our actions.

By adopting a more nuanced understanding of luck and risk, readers are encouraged to approach financial decision-making with greater humility, perspective, and resilience. Instead of viewing success as solely the result of individual merit and effort, readers are invited to recognize the role of external factors beyond their control and make more informed choices about how to navigate the uncertainties of the financial world.

Redefining Wealth and Happiness

At the heart of “The Psychology of Money” lies the exploration of the paradox of wealth: the notion that true wealth encompasses more than just financial prosperity. Housel challenges readers to redefine their conception of wealth and happiness, moving beyond the traditional metrics of income and net worth to embrace a more holistic and meaningful approach to well-being.

Drawing on insights from positive psychology and philosophy, Housel argues that true wealth is not merely a measure of material possessions, but a reflection of one’s overall quality of life and sense of fulfillment. While financial security is undoubtedly important for peace of mind and autonomy, Housel cautions against the pursuit of wealth at the expense of other aspects of life, such as relationships, health, and personal growth.

To illustrate this point, Housel shares poignant stories of individuals who have experienced the fleeting nature of material wealth and the enduring value of intangible assets such as love, friendship, and purpose. From the high-powered executive who sacrifices time with family and friends in pursuit of career success to the minimalist artist who finds joy and contentment in simplicity, these stories challenge readers to reflect on their own values and priorities in life.

By shifting our focus from accumulation to contentment, Housel argues that we can cultivate a deeper sense of well-being and fulfillment, irrespective of our financial circumstances. Whether through practicing gratitude, fostering meaningful relationships, or pursuing passions and interests outside of work, readers are encouraged to embrace a more balanced and holistic approach to life and money.

Cultivating Healthy Financial Habits

In the following chapters, Housel provides practical insights into the psychology of saving, spending, and investing, offering readers actionable strategies for building healthy financial habits and achieving their long-term goals. He emphasizes the importance of understanding the psychological forces at play, such as social norms, peer pressure, and emotional triggers, in order to make more intentional choices about money.

Housel explores the concept of “enough,” challenging readers to define their financial goals based on their own values and priorities rather than external expectations. By adopting a mindset of sufficiency and contentment, readers can cultivate a sense of financial well-being that transcends the pursuit of endless wealth accumulation.

To illustrate the power of sufficiency, Housel shares inspiring stories of individuals who have embraced a minimalist lifestyle and found freedom and fulfillment in simplicity. From the early retiree who lives frugally and travels the world on a modest budget to the philanthropist who donates the majority of her wealth to charitable causes, these stories highlight the transformative power of aligning our spending habits with our values and priorities.

By adopting a more mindful and intentional approach to money, readers can break free from the cycle of consumerism and find greater satisfaction and fulfillment in life. Whether through budgeting, saving, or investing, Housel empowers readers to take control of their financial destiny and create a life of abundance and meaning.

Embracing the Long-Term Perspective

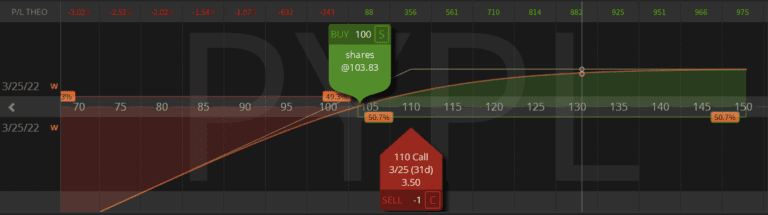

Throughout the book, Housel emphasizes the importance of taking a long-term perspective on investing and wealth-building. He argues that success in the financial markets is not determined by short-term fluctuations or market timing, but by the power of compounding and the discipline to stay the course through market volatility and uncertainty.

To illustrate this point, Housel shares compelling stories of individuals who have achieved financial independence through the power of long-term investing. From the diligent saver who invests consistently over decades to the patient investor who withstands market downturns with equanimity, these stories underscore the importance of patience, discipline, and perspective in achieving financial success.

By adopting a long-term mindset, readers can overcome the psychological barriers that often lead to poor investment decisions, such as fear, greed, and short-term thinking. Instead of trying to time the market or chase the latest investment fads, readers are encouraged to focus on the fundamentals of investing, such as diversification, asset allocation, and rebalancing.

In addition to emphasizing the importance of patience and discipline, Housel also explores the concept of embracing uncertainty as an inherent aspect of investing. Rather than viewing volatility as a threat to be avoided, he argues that volatility provides opportunities for long-term investors to buy low and sell high, thereby enhancing their investment returns over time.

By adopting a mindset of abundance and resilience, readers can navigate the uncertainties of the financial markets with confidence and clarity, knowing that they have the knowledge and discipline to weather the inevitable storms that lie ahead. Whether through investing in stocks, bonds, real estate, or other asset classes, Housel empowers readers to take control of their financial future and build a life of abundance and prosperity.

Conclusion: A Journey of Self-Discovery

In conclusion, “The Psychology of Money” offers readers a thought-provoking exploration of the intricate relationship between human psychology and financial decision-making. Through compelling anecdotes, practical advice, and profound insights, Morgan Housel challenges readers to rethink their attitudes towards money and wealth. By understanding the psychological factors that influence our financial behaviors, readers can cultivate a more mindful and purposeful approach to managing their finances. Whether you’re a seasoned investor or someone just starting out, this book offers timeless lessons that are sure to inspire and empower.